What is Capital Gains Tax?

Capital Gains tax is the tax that an investor has to pay on the income earned from his investments in a given financial year. These include income from selling stocks, mutual funds, bonds etc.

There are two categories of capital gains:-

- Short Term Capital Gains - Gains earned from securities that were held for less than a year

- Long Term Capital Gains - Gains earned from securities that were held for a year or more.

Capital Gains Tax Structure

Following table summarizes the current capital gains tax structure:-

| Direct Equity | Mutual Funds | ||||

| Equity | Non Equity | ||||

| Short Term | Long Term | Short Term | Long Term | Short Term | Long Term |

| 15.45% = 15% + 3%* | Nil | 15.45% = 15% + 3%* | Nil | Applicable Income Tax Slab + 3%* | 10.30% (Without Indexation) = 10% + 3%* 20.60% (With Indexation) = 20% + 3%* |

* = Education Cess

Indexation helps in reducing the tax liability by taking into account the effect of inflation on the purchase price of a security.

Dividend Distribution Tax

Apart from Capital Gains tax there is tax implication on the dividend earned on held securities. Following table summarizes the dividend distribution tax:-

| Direct Equity | Mutual Fund | ||

| Equity | Debt Schemes | Money Market and Liquid Schemes | |

| Nil | Nil | 13.519% = 12.5% + 5%** + 3%* | 27.0375% = 25% + 5%** + 3%* |

* = Education Cess, ** = Surcharge

Capital Gains Tax Computation

Capital Gains Tax Computation is three step process.

1. Determining the holding period for the security

First step in calculating the capital gains tax is to determine the duration for which the security was held before it was sold. This is simple if there was only one buy and one sell transaction in a security. In this case it would simply be the difference between sell and buy dates. But when there are multiple buy and sell transactions in the same security then the principle of First In First Out (FIFO) has to be applied.

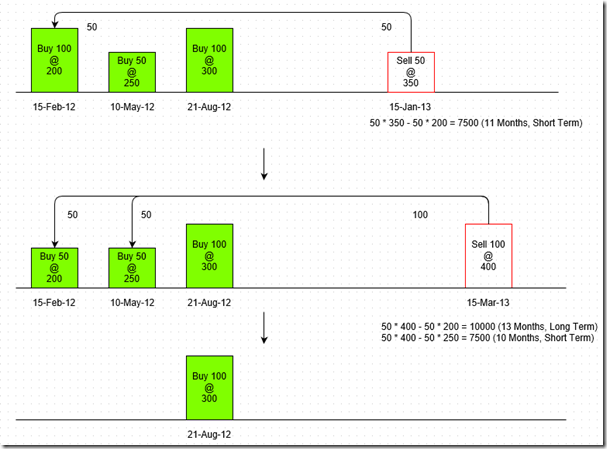

Lets try to understand using the following diagram

In the diagram above, there were three buy transactions and two sell transactions. First sell transaction occurred on 15-Jan-13. Shares sold under this transaction would be adjusted against shares bought on 15-Feb-12. Since the holding period for these shares was 11 months therefore, it would be considered as short term capital gain. Second sell transaction of 100 shares happened on 15-Mar-13. Now first 50 shares out of the 100 would be adjusted against 50 shares bought on 15-Feb-12. Since holding period for these was 13 months, therefore, it would be considered as long term capital gain. Second 50 would be adjusted against 50 shares bought on 10-May-12. Since holding period for these was 10 months, therefore, they would be considered as short term capital gains.

2. Computing the Capital Gains

After computing holding periods for all the security transactions we would compute the capital gains earned for each of the transaction. Following table summarizes the capital gains earned in the example above.

| Sell Transaction Date | Corresponding Buy Transaction Date | Holding Period | Capital Gain Type | Capital Gain |

| 15-Jan-2013 | 15-Feb-12 | 11 Months | Short | 50 * 350 – 50 * 200 = 7500 |

| 15-Mar-2013 | 15-Feb-12 | 13 Months | Long | 50 * 400 – 50 * 200 = 10000 |

| 15-Jan-2013 | 10-May-2012 | 10 Months | Short | 50 * 400 – 50 * 250 = 7500 |

3. Computing Tax Liability

| Financial Year | Capital Gain Type | Capital Gain | Tax Liability |

| 2012-13 | Short | 7500 + 7500 = 15000 | 15000 * 0.15 = 2250 |

| 2012-13 | Long | 10000 | Nil |

Same procedure can be applied for all the instruments held in the portfolio to determine the capital gain type and the actual capital gain tax for the overall portfolio.

I hope this would help the investors in clarifying the tax calculations for their portfolio.

Hi.....................

ReplyDeleteThanks for your marvelous posting! I quite enjoyed reading it, you are a great author.I will be sure to bookmark your blog and definitely will come back from now on. I want to encourage that you continue your great job, have a nice day.

Income Tax Calculator India

Thanks a lot for your nice and encouraging words. I am planning to write my next post on portfolio performance measurement, topic which is very close to my heart. Please do share if you have some topic in your mind which would help general investor.

Deletevery well explain about capital gain tax. better understandable by the table and graph. i highly recommended this blog for sure. thanks for sharing such a good information blog with us. Thanks Capital Gain tax services Brisbane

ReplyDeleteGreat! Thanks for sharing this great post. I am hoping to read more helpful articles from you. Thanks! Taxation Services Brisbane

ReplyDeleteI found your post really helpful. It is not so easy to calculate capital gains tax for portfolio but you have explained everything so nicely that anyone with a little knowledge can calculate it. I am a beginner investor and usually consult certified financial planner india to add only right options to my portfolio.

ReplyDelete